If You Want to Be Rich, Stop Thinking Like A Poor Person

Whether you think it makes the world go round or it’s the root of all evil, there are few things that motivate human beings the way that money will. In a world where most of us have the desire to be rich, we spend our entire lives stuck in a poor person’s mindset, because that is what society has taught us to do.

If you won $1,000,000 in the lottery, what would be the first three things you bought? If you're like most people, your answer probably includes the following:

- A house

- A car

- A vacation

Now, there is nothing wrong with wanting nice things. I dream of one day owning one of these. But depending on how extravagant you are, your sum of $1,000,000 could quickly evaporate. Stories about lottery winners who end up broke, or professional athletes filing for bankruptcy are so common because people who have never had money before are unable to control the impulse that tells them to ‘Spend, spend, spend!’

A Poor-Minded Way Of Thinking

We’re taught the importance of getting good grades in school, so you can get a good job and a good salary, so you can buy a nice house in the suburbs. That’s the dream, or so we’re told. Earn money, spend money, repeat.

Did you know that 80% of Americans are in some form of debt? When you can buy pretty much anything on credit, and credit cards often come with ridiculously high limits - I took out an American Express card when I was in my early twenties which had a credit limit of £8,000! Is it any wonder society is indebted up to the eyeballs?

Ponder this for a moment:

Most people spend the better part of their lives working to pay the mortgage on a house they never get to enjoy because they're too busy working to pay for it.

Then when the bills are all paid, try to save some money if you can. But with rising numbers of Americans unable to cover a $1,000 emergency expense, something needs to change.

The fault lies at the feet of society. By the time we leave school, we know Pythagoras Theorem, trigonometry, and how to make a battery out of a potato, but we haven’t the foggiest idea of how to deal with money.

Photo by King Lip on Unsplash

But have no fear, for Super-Jon is here, with four money lessons that most people never learn.

1) Pay yourself first

This one probably goes against everything the world has ever taught you. Where most people spend their paycheck and save if (and only if!) there’s anything left, the path to financial freedom takes a different road.

In the same way that your mortgage company would pay someone to knock down your door if you stopped paying, you need to think of yourself as your most significant creditor. Your financial future, and that of your family, should be your most important obligation, but it never will be unless you prioritize paying yourself first.

Start by working out your income and your expenses, then work out how much you can realistically afford to save each month.

Then stick to it.

Set up an automatic transfer on payday, so you don’t even see it. Even if it’s only $25 or $50, the fact you’ve paid yourself first means that $25 or $50 is in your pocket at the end of the month. And if you have to sacrifice your daily $5 latte or the $60 per month gym membership you never use? So be it. Buy one of these, it'll pay for itself after a few days.

Pay yourself first, then spend what’s left.

2) It’s not about how much you earn, but how much you keep

If you asked 1,000 people why they struggle to save money, most answers would say something along the lines of, “Because I don’t earn enough.” But nobody ever says, “I spend too much money,” do they? That would be the honest answer for a lot of us, and it’s the root of the problem.

Imagine two people, let’s call them Mike and James:

- Mike earns $250,000 a year. James earns $100,000 a year.

- Mike enjoys the finer things in life, and every year he spends almost his entire $250,000 a year salary. At most, he saves $10,000 a year.

- James manages to keep his expenses in check, and he saves a third of his $100,000 salary every year. Assuming their situations stayed the same, who’s the wealthier of the two after five years?

It’s not about how much you earn, but how much you keep.

3) Invest early, invest often

I’ve written a lot about investing, and have spent even more time studying it. I began working at the age of sixteen; I believe with every fibre of my being that if I’d had the same understanding of investing as I do today, I’d be well on my way to retirement by now. Don’t believe me? Then let me introduce you to the magic of compound interest.

Compound interest is the process through which the interest you make on your money, also makes interest. Sounds boring as hell, right?

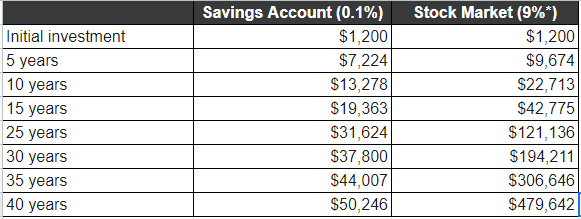

Imagine that you have a spare $1,200 lying around. You’ve heard you can get decent returns in the stock market, but your neighbour told you he once lost money on investments and advised that you steer clear. You put the money in a savings account instead, which pays interest of 0.1%. You then make additional deposits of $100 per month, a total of $1,200 a year. Let’s see what happened after forty years.

Screenshot property of the author.

*Based on the historical rate of return from the stock market.

The returns you'd get from investing in the stock market are almost ten times what you'd get from putting the money in savings. Pretty impressive right? And all it took to achieve that sum was a relatively small initial investment, followed by a deposit of $100 a month. It sounds simple because it is that simple.

Time is one of your most precious assets. Take advantage of it, and you can set yourself up for financial freedom. Play around with this calculator to see what it would take for you to retire a millionaire. It is very achievable if you start early enough.

Invest early, invest often

4) Know what you own — the difference between assets and liabilities

In his best-selling book, Rich Dad, Poor Dad, Robert T. Kiyosaki discusses the differences between the rich, the poor, and the middle-class. He writes:

“Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.” “An asset puts money in my pocket. A liability takes money out of my pocket.” — Robert T. Kiyosaki

You often hear people saying that their house is their greatest asset. The reality is quite the opposite. Unless you’ve fully paid off your mortgage, your house is taking money out of your pocket every month, making it a liability, not an asset. If you were to buy a second property through which you can earn rental income, that would be an asset, as it puts money into your pocket.

Similarly, people that buy brand-new cars often refer to them as assets, yet we all know that when you buy a brand-new car, it will be worth 10-15% less by the time you’ve driven it home, and roughly 40% less by the time you’ve owned it a year.

Know what you own, and remember: assets put money **in **your pocket, liabilities take it out again.

A shift in mindset

The path to achieving wealth takes more than merely sticking money in the bank or an investment account and hoping to get rich. It requires a significant shift in mindset. It requires you to unlearn the poor person’s “earn money, spend money” mindset that we’ve all been indoctrinated into. It requires you to look at every single dollar you earn through a lens and imagine the possibilities it can provide. Remember:

- Pay yourself first

- It’s not about how much you earn, but how much you keep

- Invest early, invest often

- Know what you own — the difference between assets and liabilities

The lessons required to truly master the power of money would require much more than I can fit into a single blog post. But by remembering these four lessons and putting them into practice, you’ll have taken the first steps down the long path towards financial freedom.

Don't miss a single story, find me at www.jonpeterswrites.com. No ads, no bullshit, just great content.